8 things to know before using cannabis topicals

CBD topicals are all the rage, and for good reason. They reduce inflammation, heal dry skin and soothe pain, among other things. But why do they work so well? We have answers.

While cannabis-infused salves, rubs, lotions and oils are still powerhouses when it comes to reducing inflammation, healing dry, patchy skin and going deep into tissue to soothe pain or irritations, a new batch of beauty products have also cropped up, most of them infused with CBD.

Why do they work so well on the skin?

Aside from most companies using high quality carrier oils to deliver the cannabinoids, the skin itself is riddled with our body’s endocannabinoid system, meaning that there are CB2 receptors all over our epidermis just waiting to be filled.

“Apparently most, if not all, skin functions are controlled to a certain extent by the local skin endocannabinoid system,” Tamás Bíró, PhD, said to Elle. Bíró is an adviser for Phytecs, a biotech company researching and developing products targeting the endocannabinoid system for medical, nutraceutical and cosmetic industries.

You put it directly where the pain is

Most people using topicals are using them for aches, pains, arthritis and other sore spots. The beauty of a topical is that you massage it into your skin right where the pain is affecting you most. Different carrier oils go deeper than others, but most topicals seem to have the miraculous property of getting in there and addressing what hurts.

Speaking of massage…

Take your massage to the next level by going to one of the many CBD-themed massage parlors cropping up. Or, if you’d rather be frugal, have a loved one give you one of the best rub downs of your life. The soothing cannabinoids don’t just alleviate sore muscles and stress, they also keep the masseuse’s hands from getting sore and keeps them well hydrated.

Topicals treat skin psoriasis

The itchy, irritated, red skin that happens with psoriasis is painful, as anyone with the disorder will tell you. Psoriasis affects 7.5 million Americans, according to the National Psoriasis Foundation, and the disease can be associated with more serious health conditions like heart disease, diabetes, and depression. Topicals can help relieve the inflammation caused by psoriasis while the moisturizing properties can combat the scaly buildup.

How to tell if you’re getting the right rub…

To begin with, make sure that the ingredients are from sustainable sources and are of the highest quality. Companies that care about what they’re putting into their products care even more about the patients who are using them.

As stated earlier, having some activated THC in the lotion is most effective due to marijuana’s entourage effect. However, CBD topicals are little miracle workers, too, so don’t be down if you’re living in a THC-dry state.

CBD cosmetics are the big thing right now!

From Renew Pure Radiance Oil to Crème de la Mer facial moisturizing cream, a new, high-end market of CBD beauty products has hit the shelves and online stores. They absorb quickly and use concoctions that won’t clog pores and will keep skin tones even and soothed. Milk Makeup’s KUSH High Volume mascara is another recent and trendy addition to the CBD beauty world.

All the benefits add up

Topicals are a natural way to slow or halt the use of synthetic pain relievers, which wreak havoc on the liver and other organs.

Topicals of course address inflammation and the other previously mentioned afflictions and with so many applications, the vast appeal has not only provided relief to hundreds of thousands of patients, it’s further legitimized cannabis use among unlikely demographics. Lotions, balms, and rubs offer relief for the growing amount of seniors who want to mitigate aches and pains with weed.

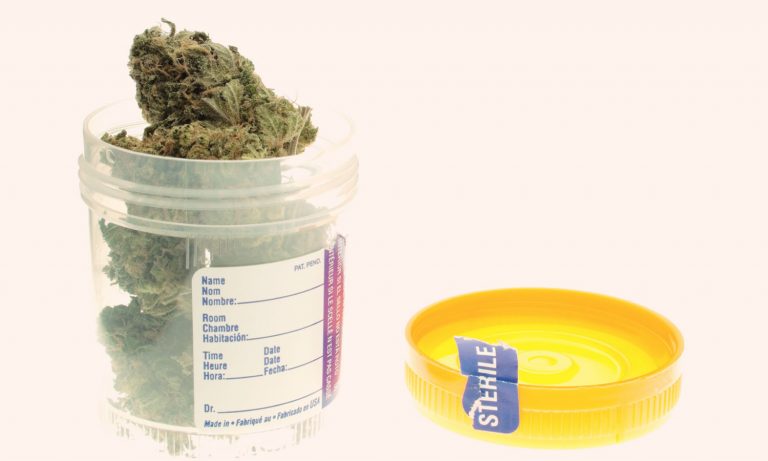

Topicals are discrete and non-psychoactive

Even if other herbs or essences like menthol are being utilized in the cream, once it absorbs there is no visible or sensory giveaways that you’ve just used marijuana. Creams and such are perfect before or during work, especially if you’re on your feet all day, and they won’t show a positive result on a drug test or get you high, making topicals the work accessory that should always be at the ready. You can even use it on a paper cut. The possibilities are endless.