After a boom in 2018 and bust in 2019, here's what to expect from weed stocks in 2020

After a 2018 that featured cannabis stocks exploding to record highs, there weren’t many highs for the cannabis industry to celebrate in 2019.

Despite a strong start in the first quarter to recover from the overall market’s year-end jitters last December, the marijuana sector as measured by the Alternative Harvest MJ ETF (MJ) has trailed the 27% annual return posted by the S&P 500 since July. The marijuana-focused ETF is now pacing to close 2019 about 35% in the red.

Out of the 10 largest publicly traded cannabis companies, only one — Massachusetts-based Curaleaf (CRLF) — is slated to end 2019 in positive territory, gaining 6% as of mid-December. And even the man at the helm of that company, Curaleaf CEO Joe Lusardi, defended the overall sector in November, noting that stock performance and underlying fundamentals don’t always move in lockstep. “The equity markets aren’t always necessarily correlated to the underlying business,” he said.

That may be true, but if 2018 was a year in which irrational excitement perhaps pushed cannabis valuations above fair value and 2019 was the year things came back down to earth, is 2020 shaping up to be another strong year for the sector?

The answer might depend on some crucial regulatory votes — from who wins the presidency, to more states legalizing marijuana, to whether Congress decides to finally advance landmark marijuana legislation that now hangs in the balance.

“That’s really the big wildcard as we head into 2020,” CFRA analyst Garrett Nelson tells Yahoo Finance, highlighting a nearly 20% rally in weed stocks after the first-ever bill set to legalize marijuana at a federal level advanced out of the House Judiciary Committee this November. The bill, the so-called MORE Act which also looks to address certain criminal justice reform issues, has yet to be approved by the U.S. House of Representatives, but another, the Safe Banking Act, which would allow legal cannabis companies to work with banks, now just awaits Senate approval after overwhelmingly passing the House.

Legalizing marijuana

Then there is the presidency. As President Trump battles for re-election, it’s worth noting that all of the major Democratic candidates, with the exception of former Vice President Joe Biden, have supported legalizing marijuana if they are elected. During the latest Democratic debate, Senator Corey Booker joked that he thought Biden was high when he said he wouldn’t support federal legalization. The next day, the Alternative Harvest MJ ETF enjoyed its greatest single-day gain since its inception.

According to Nelson’s modeling, if a pro-legalization president is successful in legalizing marijuana at a federal level, it could set the sector up for major gains, as evidenced by an estimated doubling in the share price of the largest cannabis company Canopy Growth.

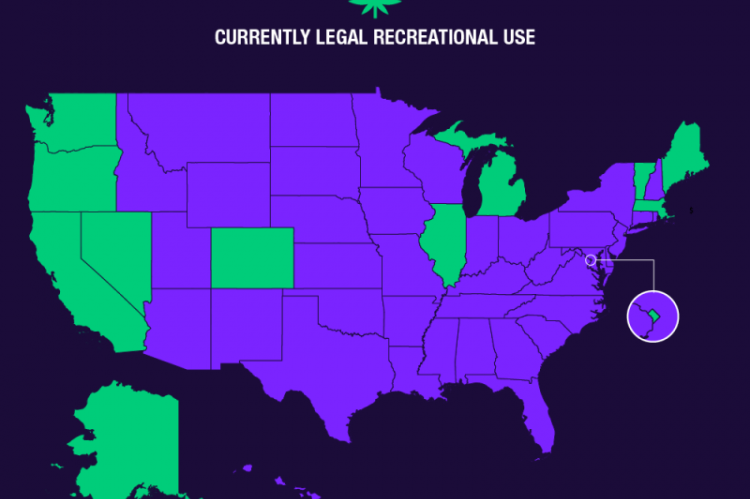

However, it might not even take something as groundbreaking as legalization at the federal level in 2020 to reverse negative sentiment for cannabis stocks. Following Illinois, which became the 11th state to legalize recreational marijuana this year, voters in states like New Jersey, Arizona, and potentially Arkansas might have the chance to vote for recreational legalization through state ballot initiatives. The impact of all or any of those states coming on line will likely impact multi-state operators differently, just as the theme was in 2019.

In fact, the overall theme of individualization in the sector, with an increased focus on which companies were showing improving fundamentals versus just an increase in footprint is likely to continue as well. As evidenced by the 55% year-to-date drop for Aurora Cannabis (ACB), which suffered from missing its own revenue expectations last quarter, companies that continue to delay profitability will continue to get punished for doing so. The same message manifested in a regime change at Canadian cannabis giant Canopy Growth (CGC), which recently named a new CEO to replace its ousted cofounder Bruce Linton after its Constellation Brands-led board grew impatient with the slow return on investment. Constellation Brands invested $4 billion in Canopy last year and named former Constellation Brands CFO David Klein Canopy’s new CEO this December.

However, as even Linton was quick to point out, many of Canopy’s peers will enter 2020 without the same luxury of a giant $2 billion cash pile to put to use. Other cannabis companies could run into liquidity problems, or be forced into less than favorable mergers without the same amount of cash to work with. For example, Acreage Holdings (ACRGF) has tumbled roughly 70% this year after signing its agreement to merge with Canopy Growth upon the sale of marijuana being legally permissible in the U.S. At the time in April, Acreage CEO Kevin Murphy said he took the deal because he had “an obligation to shareholders.”

But major mergers and acquisitions weren’t always negatives in 2019. For Curaleaf, two major acquisitions, including a record-breaking $950 million deal to acquire Cura Partners, the leading cannabis brand in some of the most mature markets, helped set the company up for the $1 billion to $1.2 billion in revenue its projecting for 2020.

Yet, as the cannabis sector continues to mature in the wake of the repricing that carried out throughout 2019, valuations might return to some of the 2018 loftiness, according to the CEO and founder of Cannabis Data Firm BDS Analytics Roy Bingham.

“We’re going to see a market that this year will grow over 25%, it’s just that some of the stocks have really crazy expectations, let’s face it. In terms of the overall growth rate, you can’t have a 100% compounded annual growth rate year after year,” he said, adding that the winning companies have at least gotten smarter about sourcing the products consumers actually want for cheaper. “You see a [gross] margin starting to improve and we’ve seen that in the U.S. consistently now.”

In 2020, that blueprint for success will likely call for showing the same things, from a higher margin mix of derivative and medical products to a trend towards profitability. The question remains to be seen, however, which companies might be around to get there while the growth opportunities still exist.

- Log in to post comments