How To Play The U.S. Cannabis Industry In 2020

-

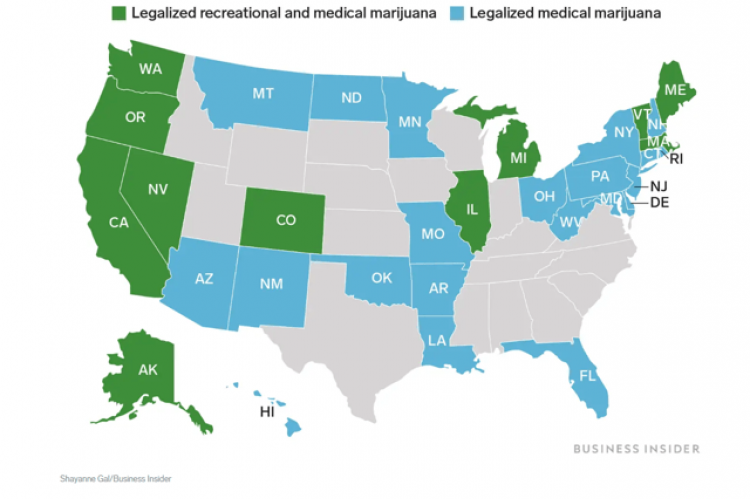

The U.S. cannabis market is quickly developing with medical marijuana currently legal in 33 states and recreational pot legal in 11 states.

-

Our top picks are Curaleaf, Green Thumb, Trulieve, and Charlotte's Web based on management, footprint/scale, balance sheet, and profitability.

-

We believe there are multiple ways of playing the U.S. cannabis sector but a prudent approach involves a basket of 3-5 stocks to reduce risk.

The U.S. cannabis industry is one of the fastest-growing and has already produced some of the largest cannabis companies in the world. The industry is evolving fast and it is important to diversify and focus on only the high-quality names. Given the nascent nature of the U.S. cannabis sector, we have observed a high level of company-specific risks. Thus, the basket approach helps mitigate company-specific execution risks and provides better exposure to the secular trend of increasing acceptance of cannabis.

Introduction

Most U.S. cannabis companies focus on either a multi-state model or a single market focus. We think both operating models could produce successful businesses. Our top picks are Curaleaf (OTCPK:CURLF), Green Thumb (OTCQX:GTBIF), Trulieve (OTCPK:TCNNF), and Charlotte's Web (OTCQX:CWBHF) based on their leading footprint, large addressable market, and strong financial position.

Multi-State Operators ("MSO")

The largest multi-state operators have seen their ups and downs in 2019. From the initial hype to downsizing, only a small number of MSOs emerged stronger from last year. We think Curaleaf and Green Thumb are among the strongest operators. Curaleaf has one of the largest footprints and has executed well on the M&A front. The company will operate one of the largest platforms in Canada once its acquisitions of Select and Grassroots closed. Green Thumb is another strong operator that has done an excellent job of securing licenses through applications. As a result, the company has grown efficiently that resulted in a portfolio of well-run and high-quality assets.

Other MSOs face certain issues that made them less appealing, in our view. Acreage (OTCQX:ACRGF) has been acquired by Canopy Growth (CGC) which eliminated any future potential, rendering the stock meaningless for the purpose of investing in the U.S. cannabis market. MedMen (OTCQB:MMNFF) has declined from a market darling to a struggling small-cap stock due to stretched financials and failed acquisition of PharmaCann. iAnthus (OTCQX:ITHUF) is also facing several headwinds including a high cost of capital and significant investment requirements given its relatively underdeveloped footprint. Harvest Health (OTCQX:HRVSF) and Cresco Labs (OTCQX:CRLBF) are two other large MSOs that could become significant players in the MSO space. We think Harvest Health has faced setbacks with financing and regulatory issues. Cresco Labs is acquiring Origin House which could pressure its near-term margins given the target's significantly lower profitability and capex requirements.

Charlotte's Web remains a leader in the CBD category with its recent investments in new capacity and experienced management team. We think the current business environment is challenging for all CBD companies given the lack of FDA rules and a plethora of similar products flooding the market. However, we think CWEB will emerge as the category leader given its established brand power and focus on the future.

Single-State Operators (1-3 States)

Our top pick in this category is Trulieve which remains the dominant player in Florida. The company has achieved possibly the best financial performance in terms of consistent revenue growth and high profitability. We think Trulieve has executed flawlessly in Florida but its next challenge would be to replicate its Florida success in other states. It has made small acquisitions in Massachusetts, California, and Connecticut.

Liberty Health (OTCQX:LHSIF) is another fast-growing operator in Florida. However, we think the stock has limited potential outside Florida given its management depth and access to capital, thus handicapping its potential. Planet 13 (OTCQB:PLNHF) operates a highly successful Superstore in Las Vegas but growth has stalled after the initial launch. The company is looking to build another location in California which will make or break its growth outlook. Ayr Strategies (OTCQX:AYRSF) is another operator with locations in Massachusetts and Nevada. The company was formed via a SPAC so it remains a relatively new entrant with a limited track record.

Valuation

Valuations dictate whether a good company can be a good investment. If a good company is trading at expensive valuations, it might not be the best time to buy this stock. Given the dearth of profitability among cannabis companies, it makes sense to look at market cap / annualized revenue. The chart below shows the valuation across major players. Curaleaf is the only expensive at 11x annualized sales which we think is justified by its leading footprint and M&A pipeline. On the lower end, Ayr Strategies is only 2.0x annualized sales likely due to its short corporate history and lack of awareness among investors. Trulieve looks cheap but the discounted valuation reflects investor concern about its growth outside Florida. In general, large MSOs command a premium while single-state operators trade at lower levels, reflecting growth and scale. Liberty Health stood out as a very expensive stock especially considering its single focus on Florida. However, the company has been building new stores rapidly which means revenue could catch up very quickly as well.

Conclusion

Our top picks for 2020 included Curaleaf, Green Thumb, Trulieve, and Charlotte's Web. These companies combine scale, strong balance sheet, profitability, and near-term growth outlook. We also demonstrated that MSOs are valued at a premium compared to single-state operators. Most times, valuation is justified by scale and growth outlook but we think 2020 will see more emphasis on profits. As the market matures and companies reach critical mass, profits will follow. We also think that investors will focus on asset quality rather than the number of states as a proxy for potential market sizes.

Ultimately, we believe there are multiple ways of playing the U.S. cannabis sector and a prudent one involves a basket of 3-5 stocks. This approach reduces execution risk but offers upsides to the secular trend of acceptance. We believe investing in companies with strong balance sheets, focus on profitability, and access to high-growth markets will be the winning strategy in 2020 for the U.S. cannabis sector.

- Log in to post comments